Odoo's Australian Fiscal Localization, tailored specifically for Australian accounting practices, ensures seamless compliance with tax laws and reporting requirements. From GST to BAS and TPAR reporting, Odoo simplifies financial operations for Australian businesses.

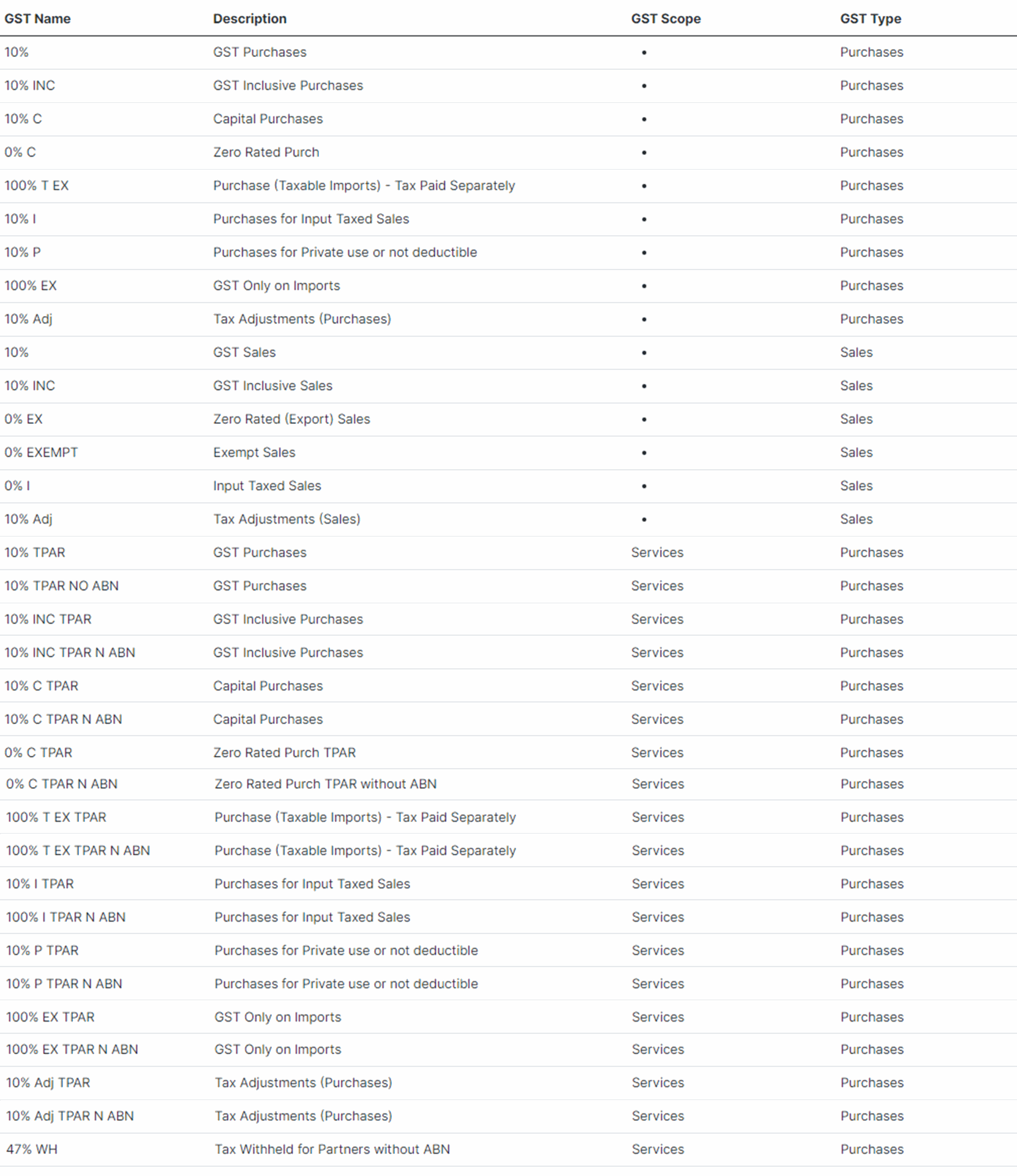

Taxes and GST

The Australian Fiscal Localisation module within Odoo accounting seamlessly handles Goods and Services Tax (GST) obligations. With configurable GST rates and precise tax mapping, businesses can ensure accurate tax reporting and compliance. The BAS Report simplifies GST reporting by categorizing transactions and facilitating effortless submission to the Australian Taxation Office (ATO).

Here are the taxes for Australia in Odoo 17:

Image Source: https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/australia.html

Image Source: https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/australia.html

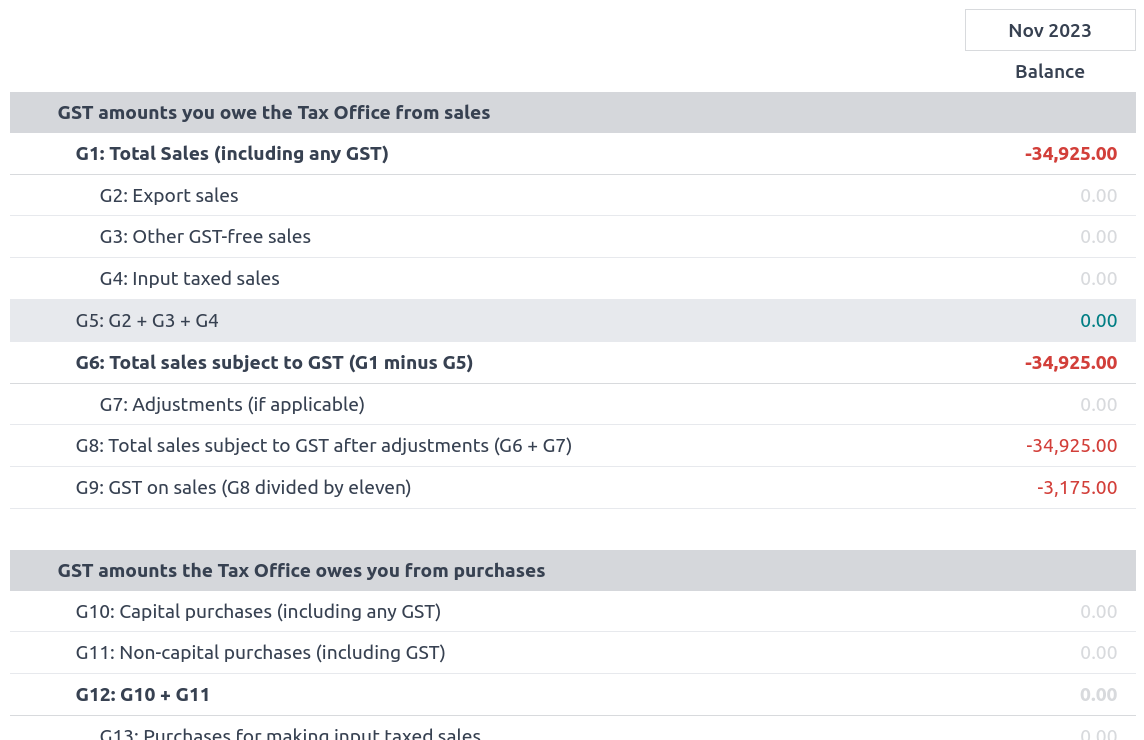

BAS Report

The Business Activity Statement (BAS) report is a critical component of Australian tax reporting. Odoo's BAS feature enables businesses to report GST and PAYG tax withheld seamlessly. By automating tax calculations and integrating with payroll systems, Odoo ensures accurate reporting and compliance with ATO guidelines.

Image Source: https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/australia.html

TPAR Report

For businesses engaging subcontractors, the Taxable Payments Annual Reports (TPAR) feature in Odoo simplifies reporting obligations. By automatically generating TPAR reports based on fiscal positions set for contacts, businesses can accurately report payments made to subcontractors and maintain compliance with ATO requirements.

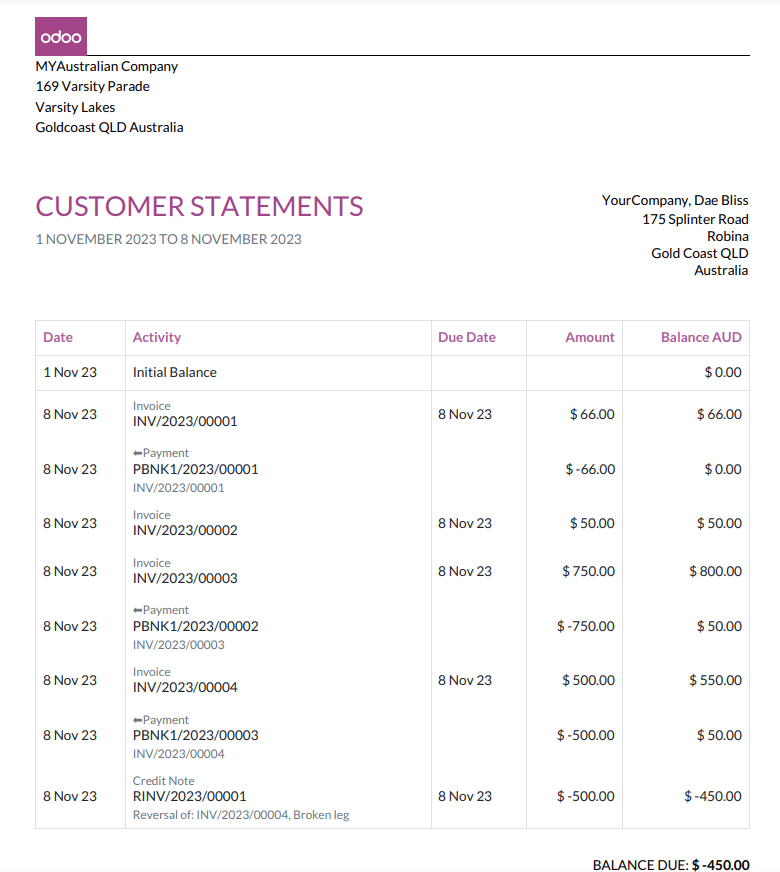

Customer Statements and Remittance Advice

Odoo's accounting capabilities extend to customer statements and remittance advice, facilitating transparent communication with clients regarding financial transactions and payment acknowledgments.

Image Source: https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/australia.html

Image Source: https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/australia.html

E-Invoicing via Peppol

With electronic invoicing settings compliant with Australia's PEPPOL requirements, Odoo enables seamless electronic invoicing between business partners, enhancing efficiency and compliance in invoicing processes.

ABA Files for Batch Payments

With the integration of ABA files for batch payments streamlines payment processing by consolidating multiple payments into a single file format compatible with Australian banks, improving efficiency and accuracy in financial transactions.

Buy Now, Pay Later Solutions and POS Terminals

Odoo supports popular payment methods such as Buy Now, Pay Later solutions and POS terminals, including Stripe and AsiaPay, catering to the diverse needs of Australian eShops and retail businesses.

For further insights, compare Odoo Accounting with other accounting systems in this comprehensive analysis.